Building Financial Resilience Through Money Tracking

The start of each month is one of my favorite times because I get to do an activity I love: tracking my cash flow. Maybe it sounds like an odd activity to enjoy, but it gives me a detailed breakdown of my spending habits, which builds my confidence in maintaining financial resilience.

Whatever your financial situation is, knowledge is power, even if it doesn’t lead you to change your behavior right away. Having a clear picture of your finances gives you the ability to make informed decisions about big things like buying a house, having a baby, retiring, quitting your job, or going on a dream vacation, as well as little things, like how often you eat out. Especially in the U.S., where there’s less of a safety net than in some other countries, your behavior with money can make the difference between desperation after a job loss and calmly riding out the storm. America is great, but no one is coming to save you.

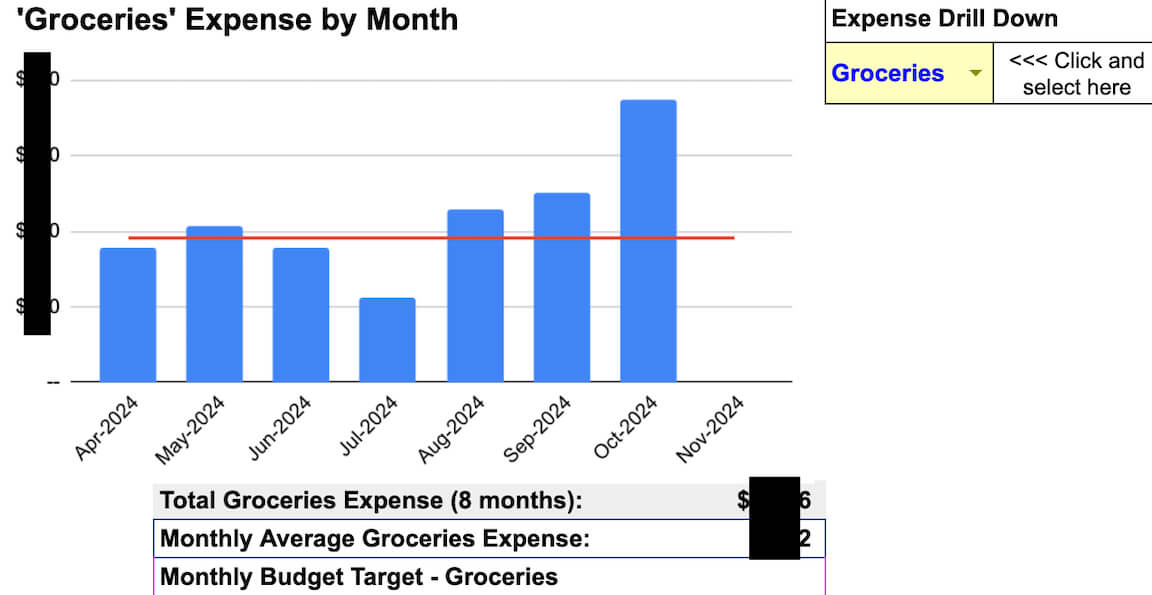

I used to have only a rough idea of my monthly expenses. I’d have a good idea about recurring expenses, and I’d roughly estimate irregular ones, like those for the house and car, but the details were hazy. For example, I value quality groceries, and sometimes I cook elaborate meals, but I didn’t know what that meant in terms of grocery spending. Also, I sometimes indulge in travel and fancy hotels, but not every month, so it was hard to quantify those expenses. I buy random things on Amazon, but I didn’t know how much that added up to. Occasionally, I buy concert tickets, but I couldn’t determine that impact either.

Now, I have seven months’ worth of data. I know, on average, how much I spend on groceries and travel each month, and I can visually compare months.

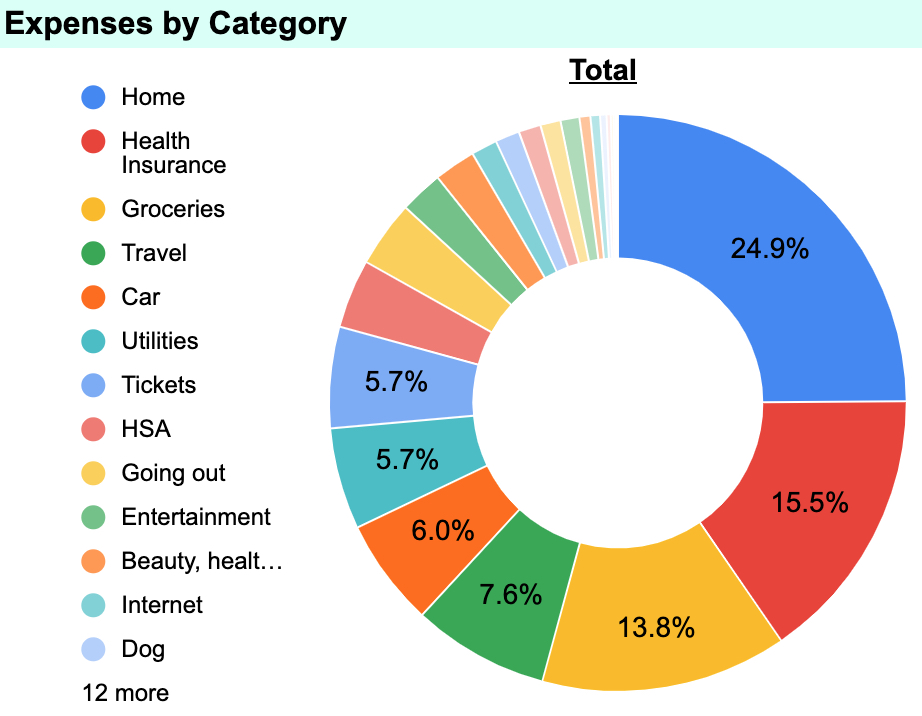

I understand which categories I spend the most on.

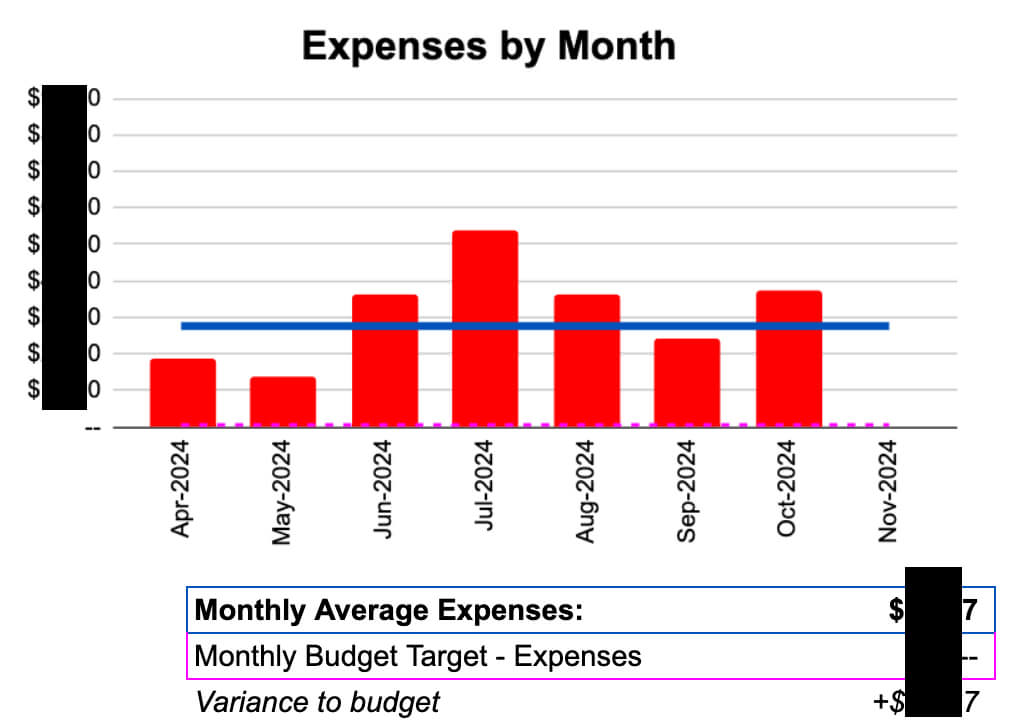

I also know my overall average monthly spending.

I look forward to having a full year’s worth of data to see the impact of irregular expenses that occur infrequently.

My process uses a spreadsheet that someone was kind enough to make and share on the internet: https://themeasureofaplan.com/budget-tracking-tool/. To set it up, I initially created categories relevant to me for both expenses and income. Each month, I do the following:

- Export credit card transactions for the previous month. Add them to the expenses sheet and assign categories.

- Export banking and investment transactions, categorize them, and add expenses to the expenses sheet and income to the income sheet (interest and dividends).

- Export HSA transactions, which might include doctor’s visits or interest/dividends on saved/invested money, and add them to the expenses or income sheets.

- Look at the beautiful dashboard of graphs! See where improvements are needed, if any.

Empower yourself with smart money habits and a clear understanding of your finances, especially your spending habits. With this data, you can make decisions that build financial resiliency leading to future financial stability, security, and independence.